non filing of income tax return consequences

Consequences of Non filing of form 10-IC. Thus Non-filing of Income Tax Return may result in the penalty of Rs.

Penalty For Late Filing Of Income Tax Return Income Tax Return Income Tax Tax Return

Non-filing your income tax returns can sometimes lead to prosecution if the IT department has a reasonable reason to believe that the taxpayer has willfully failed to furnish the returns on time.

. Losses such as business loss speculative or non-speculativecapital losslong term or short term and loss in race horse maintenance are not eligible to be carried forward as per section 80 of the IT Act. What are the consequences of non filing of Income Tax Return. This is an assessment carried out as per the best judgment of the Assessing Officer on the basis of all relevant material he has gathered.

If the form is filed for AY 2020-21 the 143 1 passed by the IT authorities consider 30 as the tax rate though 25 is eligible. Therefore just keep in mind the above consequences of non filing of your Income Tax Return and start working on it. No Default Potential Penalty Non-TP cases ie.

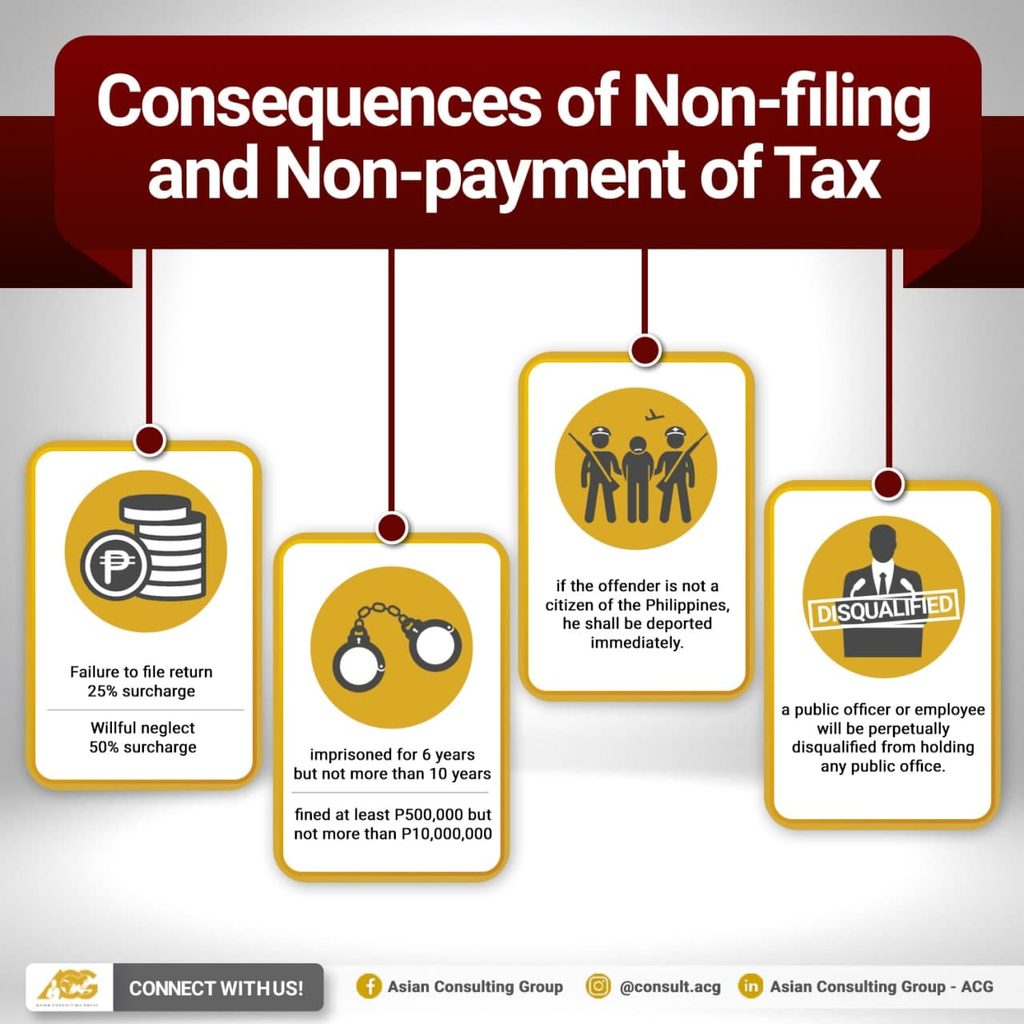

Further if such a return is filed after one year from the end of the tax year concerned apart from the interest they will also be liable for a penalty of Rs 5000. If you do not file a return and there is assessable income you are liable to a penalty for concealment of income which ranges from 100 to 300. C onsequences of non-filing of Income Tax Return.

There is also a penalty of Rs 5000 if the IT return is not filed within one year of the end of the financial year. Carry forward of Losses not allowed except in few exceptional cases. Filing an ITR is a way to let the government know about your income.

Income Tax Return Filing is one of the most important aspects of personal finance management. For possible tax evasion exceeding Rs25 lakhs. Penalty for not filing ITR plus imprisonment of at least 6 months which can extend to 7 years.

If the tax due is more than 10000 then you must pay an advance tax on your income. In a judgment the Delhi High Court held the prosecution proceedings even when the taxpayer was entitled to a refund. The Income Tax Department of India has lowered the maximum penalty for late tax filing from Rs.

AO can issue notice us 142 1 if the return is not filed before the time allowed us 139 1. However section 285BA5 empowers the tax authorities to issue a notice and ask the person to file the statement within a period not exceeding 30 days from the date of service of the notice. Section 271c of the Income Tax Act deals with penalty for concealment of particulars of income or for furnishing incorrect particulars of income.

Non- filing of income tax return leads to heavy penalties with interest us 234 A 234 B and 234 C accordingly. Acting Tough against Non Filers of Income Tax Returns. May lead to Best judgment assessment by the AO us 144.

1 Penalty us 271F. Penalty provisions for non-filing of tax return TP report S. If your gross total income before allowing any deductions under section 80C to 80U exceeds the basic exemption limits as prescribed by the Income Tax Department you have to mandatorily file your Income Tax Return for that Financial Year or Assessment Year.

Penalty under Section 234F. It is mandatory on part of every individual to file the Income Tax Return and also the person will be penalized under section 234A of the Income Tax Act. Upon conviction the company may face a fine of up to 1000.

If you do not inform the government you have to face penalties problems. Consequences of non-filing of SFT If any reporting authority fails to SFT a penalty under section 271FA can be levied of Rs. Thus Non-Filing of the Income Tax Return may result in the Best Judgement Assessment.

The company must still file the outstanding documents failing which further legal actions may be taken. New Powers of FBRDisabling of Mobile SimsDisconnection of Electricity MeterDisconnection of Gas Meters along with other penalties on non return filersSeek. Consequences of Non-Filing of the Income Tax Return If a person fails to furnish return before the end of the relevant assessment year the assessing officer may levy a penalty of Rs.

No transactions with Associated Enterprises in India 1 Enhanced penalty in light of the amended penalty provisions as per Union Budget 2016 50 per cent of the tax computed on the assessed income without giving credit of withholding tax or. If you are Read More Consequences of Non-Filing of the Income Tax Return. Individuals filing income tax returns beyond the due date have to pay these penalties.

500 per day of default. Section 139 1 b of the Income-tax Act 1961 provides that in case of a person other than company or Firm Return of income is required to be filed if total income exceeds basic exemption limit. Penalty for Concealment of Income Us 271C of Income Tax Act 1961 If a person has taxable income and do not file the return of Income may end up paying penalty for concealment of Income.

Thus Non-filing of Income Tax Return may result in the penalty of Rs. A company director convicted for failure to comply to Section 65B 3 could face a fine of up to 10000 or imprisonment of up to 12 months or both. As per recent amendments in Section 234F of the IT Act taxpayers who file ITR after the deadline have to pay a maximum fine of Rs.

Prescribed penalty plus imprisonment of at least 3. Income tax is a tax imposed by the Indian Government on income of a person. The specifics regarding imprisonment are as follows.

But here we are discussing only the adverse consequences of Non-Filing of the Income Tax Return. If a person fails to furnish return before the end of the relevant assessment year the assessing officer may levy a penalty of Rs. Filing of income tax is responsibility of every citizen.

As per Sec 115BAA Beneficial rate of 22 is eligible only when form 10IC was filed before filing the ITR by a domestic company. If individuals file their returns after the last date of filing Return of Income they will be charged interest at the rate of 1 per month of delay.

Not Verifying Your Income Tax Returns Might Have Serious Consequences Business Standard News

Consequences Of Non Or Late Filing Of The Income Tax Return

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

For How Many Previous Years A Taxpayer Can File Income Tax Return Income Tax Return Income Tax Tax Return

Consequences Of Not Filing Taxpayer Advocate Service

Buying Property From Nri And Consequence Of Non Deduction Of Tax Buying Property Deduction Tax

What Happens If Itr Is Not Filed What Are The Consequences

Penalty For Late Filing Of Income Tax Return Ebizfiling

Irs Notice Cp515 Tax Return Not Filed H R Block

Penalties For Claiming False Deductions Community Tax

Pin On Best Of Canadian Budget Binder

Consequences Of Delay In Filing Itr Non Payment Of Tax And Non Filing Of Income Tax Return Naveen Fintax Income Tax Return Income Tax Tax Return

Ask The Tax Whiz Consequences Of Non Filing Non Payment Of Tax Returns

Income Tax Filing India Itr Filing Taxation Policy In India Filing Taxes Income Tax Income Tax Return

Ay 2020 21 Income Tax Return Filing Tips Which Itr Form Should You File Income Tax Return Income Tax Return Filing Income Tax

Income Tax Filing India Itr Filing Taxation Policy In India Filing Taxes Income Tax Income Tax Return

Penalty For Late Filing Of Income Tax Return For Ay 2020 21 Income Tax Return Income Tax Tax Return

You May Land Up In Jail For Non Filing Of Itr File Income Tax Business Reputation Filing